Top Congested Ports in 2025 and Tips to Overcome

Port congestion in 2025 continues to disrupt global trade, with several key congested ports experiencing record delays. Guess which ports are the most congested in 2025, here's a latest updates for you.

Most Congested Ports in 2025

Shanghai Port

Savannah Port

Bremerhaven Port

Vancouver port

Manzanillo Port

Port of Shanghai, China

The Port of Shanghai, one of the world’s busiest shipping hubs, is currently operating under significant strain. According to the latest operational update from Hapag-Lloyd, vessels at the Yangshan terminal are facing average wait times ranging from 1-3 days. The number of anchored ships remains notably high, underscoring the continued challenges at this congested port.

Port Congestion Reason:

Export Surge in May

Export volumes spiked in early May as freight forwarders rushed shipments ahead of expected freight rate hikes. This led to unusually high port throughput, worsening operational bottlenecks.

Tariff Deadline Drives Urgent Orders

The July expiry of the U.S.-China tariff truce is accelerating orders, keeping container volumes high. Shipping lines are consolidating schedules, prolonging vessel bunching at Shanghai

Port of Savannah, USA

In 2025, the Port of Savannah has became one of the most congested port in the United States, with average vessel wait times ranging from 4 to 6 days, and peak delays stretching beyond 7 days.

Port Congestion Reason:

The recent surge in vessel calls at Savannah is partly due to a temporary rerouting of some Asia–U.S. East Coast cargo via the Suez Canal, as drought conditions have limited capacity through the Panama Canal.

Moreover, the temporary suspension of U.S. tariffs on Chinese goods has triggered a sharp spike in inbound shipments, turning ports like Savannah into severely congested hubs.

Port of Bremerhaven, Germany

Bremerhaven, one of Germany’s key North Sea gateways, continues to operate under mounting pressure as a congested port. In recent months, average vessel wait times have stretched from 3 to 5 days, with some carriers experiencing delays exceeding one full week before berthing and unloading can commence.

Port Congestion Reason:

A persistent strike of workers has sharply reduced the efficiency of container handling, yard operations, and inland transfers. At the same time, critically low water levels on Germany’s inland waterways—most notably the Rhine—have crippled barge transport. With containers unable to move inland, yard space is overwhelmed, further straining already congested terminals.

Port of Vancouver, Canada

The Port of Vancouver continues to grapple with congestion in 2025, with average vessel turnaround times reaching 10+ days recently. As one of the busiest ports in Canada, Vancouver's operational delays have impacted trade routes across the Pacific. The port's aging infrastructure struggles to accommodate rising shipping volumes, leading to bottlenecks in container handling. Freight costs have surged, and supply chain disruptions are becoming more frequent. Vancouver's congestion highlights the need for investment in port infrastructure to support growing demand.

Average vessel turnaround time: 7+ days.

Several vessels arrived at the same time.

Port of Manzanillo, Mexico

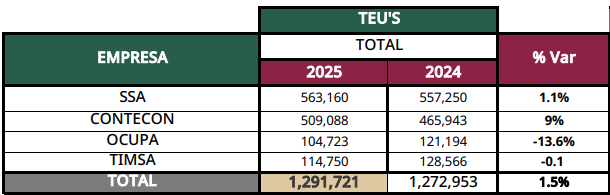

Manzanillo, a vital port for trade in Latin America, ranks among the most congested ports in 2025. In the first four months of this year, the Port of Manzanillo processed 1,291,721 twenty-foot equivalent units (TEUs), marking a 1.5% increase compared to the same period last year, according to figures released by Asipona Manzanillo.

From Source Asipona Manzanillo

However, real-time data from the port authority highlights severe operational disruptions triggered by an ongoing strike. Over 4,000 transport trucks have been stranded, with an estimated 100,000 tonnes of cargo delayed within the port zone. Storage fees are soaring at an hourly rate of 3%, while the supply chains of more than 1,500 businesses have been critically impacted.

Losses have been particularly severe in the cold chain sector, with perishable goods damage exceeding $20 million.

Note: Have questions about current port status, customs clearance, or other ocean freight details? Contact the experts at YQN Logistics today by emailing info@yqn.com.

How to Overcome Port Congestion

Port congestion 2025 has exposed vulnerabilities in supply chains worldwide. Container dwell times at congested ports have reached critical levels, causing delays in cargo movement and rising freight costs.

Here are 3 tips when facing the congested ports.

Using Tracking Tools for Smart Planning

Exporters and Importers can use AI port tracking tools to anticipate delays with real-time port status data.

Free Tools Recommended:

Project44 Port Intel

Offers real-time visibility into port congestion, berth waiting times, and dwell time analytics.

Supports smart ETAs based on live vessel positioning and historical data.

Free version available for basic port and carrier tracking.

GoComet Port Congestion Tracker

Tracks congestion levels at over 100 major global ports.

Provides live waiting times, berth capacity, and weather-related delays.

Simple dashboard to view global port performance at a glance.

Designed for both shippers and freight forwarders; integrates carrier rates, booking visibility, and port delay notifications.

API-powered live updates from major carriers and terminals in China, the Middle East, South America, and more.

Ideal for real-time freight rate comparison and container tracking.

Follow Port Strike News

Strikes and labor disputes can severely affect port throughput and delay vessel berthing. Proactively tracking these events allows businesses to reroute cargo, adjust lead times, or shift to alternate ports.

Where to monitor:

Splash247 – Real-time global shipping and port labor updates.

Journal of Commerce – In-depth strike coverage and logistics impact analysis (registration required).

Optimize Container & Inventory Management

Pairing port status data with inventory systems gives you the power to forecast disruptions and keep goods moving efficiently.

YQN’s notification system provides automated real-time alerts on vessel delays, port congestion, and unexpected disruptions. These alerts are customizable based on user routes and container IDs. This immediate awareness allows logistics managers to quickly make decisions on rerouting, rebooking, or adjusting delivery plans—minimizing impact on the overall supply chain.

Conclusion:

Port congestion in 2025 continues to challenge global trade, with major hubs like Savannah, Antwerp, and Vancouver struggling to meet rising demand. Addressing these issues is crucial for smoother operations and supply chain planning. You can plan ahead for your supply chain by contacting info@yqn.com.

FAQ

What are the main reasons for port congestion in 2025?

Port congestion in 2025 stems from increased shipping demand, geopolitical tensions, labor shortages, and aging infrastructure. These factors collectively disrupt operations and delay cargo movement.

How does port congestion affect freight costs?

Congestion increases freight costs by causing delays, higher demurrage fees, and rerouting expenses. These additional costs impact businesses and consumers globally.

Can businesses mitigate the effects of port congestion?

Businesses can mitigate congestion by diversifying supply chains, adopting advanced logistics technologies, and utilizing alternative trade routes to ensure smoother operations and reduced delays.

Tip: Stay updated on port conditions to optimize logistics strategies. Contact Logistics Plus at info@yqn.com for expert advice.

See Also

Effective Shipping Strategies Amid Increasing Port Traffic Challenges

March 2025 Freight Developments in the Chinese Market

April 2025 Freight Insights for the Chinese Market

May-June 2025 Ocean Shipping Market: Freight Rate Trends Post-Tariff

2024 Shipping Industry Growth: Insights and 2025 Forecast for Traders

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.