5 Supply Chain Strategies to Survive China’s Tariff Retaliation Against Trump Tariff

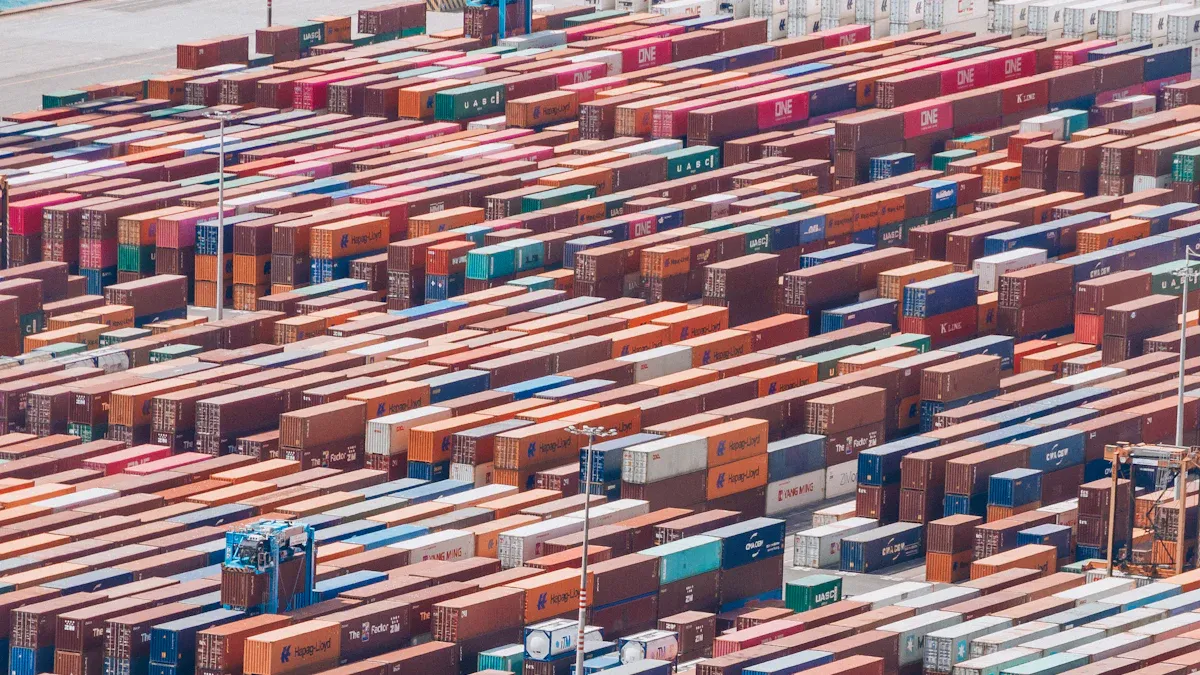

In early 2025, the U.S. imposed a new wave of tariffs on Chinese goods—some as high as 145%. Within days, China responded with its own counter-tariffs on U.S. exports, escalating tensions that many hoped had ended years ago. This development has caused disruptions across agriculture, energy, automotive, and industrial sectors.

This article outlines practical supply chain strategies that companies can adopt to minimize risk, manage costs, and stay resilient in the face of increasing tariffs and uncertainty in U.S.–China trade relations.

What Triggered China’s Retaliation?

On February 1, 2025, President Trump signed Executive Order 14195, placing a 10% tariff on all Chinese imports. The move was based on national security concerns and linked to the fentanyl crisis. On April 2, the U.S. raised tariffs by another 34%, bringing the total to at least 54% on all goods from China.

On April 10, 2025, President Trump signed a new executive order imposing a 125% “reciprocal tariff” on Chinese imports, effective immediately. The next day, the White House clarified that this was in addition to the earlier 20% comprehensive tariff, making the effective rate 145%. The move also eliminated the “de minimis” exemption, subjecting small parcels under $800 to new duties.

China responded quickly. On April 10, it announced a 34% tariff on all U.S. imports. Then on April 11, China raised the tariffs again—from 84% to 125%, effective April 12. In its official statement, China said U.S. goods were no longer competitive in the Chinese market and warned it would not respond to future tariff hikes. The Chinese government called the U.S. actions unfair and against global trade rules.

The impact was immediate. According to the USDA, U.S. farm exports to China dropped 34% in the first quarter. Oil companies also rerouted over $1.3 billion in crude shipments to Southeast Asia after China added a 10% tariff on American oil and LNG.

Five Practical Strategies to Navigate the Tariff Fallout

1. Diversify Regional Supply Chains

Over-reliance on China as a manufacturing base exposes companies to tariff risks. Many businesses are shifting part of their supply chain to Southeast Asia, Mexico, and India.

For example, several U.S. apparel brands have expanded sourcing to Vietnam and Bangladesh, reducing lead times and avoiding Chinese tariffs. Mexican factories are also seeing increased demand for final assembly and packaging.

Tip: Maintain a “China+1” sourcing strategy to balance cost efficiency and risk mitigation.

2. Review and Update Trade Contracts

With tariffs in flux, it’s critical to update existing contracts to include tariff adjustment clauses. These clauses allow flexibility in pricing, payment terms, and sourcing based on changes in trade policies.

Legal experts recommend including a “force majeure” or “tariff trigger” clause that allows renegotiation if duties exceed a certain threshold.

Tip: Work with trade compliance consultants to review all major contracts and identify exposure points.

3. Expand Market Access Beyond China

While China is a major market, U.S. exporters are finding opportunities elsewhere. South Korea, Brazil, and the EU have shown stable demand for U.S. agricultural and energy products.

For example, U.S. soybean exporters increased shipments to Egypt and Indonesia by 22% in Q1 2025 after Chinese tariffs were imposed. Automotive parts manufacturers are targeting Mexico and Eastern Europe for increased sales.

Tip: Explore new FTAs (Free Trade Agreements) and leverage tariff-free quotas in alternative markets.

4. Optimize Documentation and Valuation:

Ensure that product documentation and valuation are accurate to avoid misclassification and penalties. Over-declaring or under-declaring the value can lead to significant costs and delays in customs clearance.

Stay informed by monitoring updates from the General Administration of Customs, consult with experts, and implement internal controls. Using compliance software can streamline processes, reducing errors and ensuring goods clear customs without delays or penalties.

Tip: YQN's expertise in handling imports can help navigate these complexities. Free consultation by contact info@yqn.com.

5. Strengthen Supplier Relationships

Good supplier relationships help businesses respond quickly when tariffs or disruptions occur. For example, during COVID-19, Delta Airlines supported its key suppliers with financial aid, ensuring continuity.

Companies like Dell and H&M involve suppliers in planning and R&D, helping them cut costs and meet sustainability goals.

Set clear KPIs for supplier performance:

On-Time Delivery ≥ 95%

Quality Assurance ≥ 98%

Cost Efficiency: Within budget annually

Tip: Conduct regular supplier evaluations and joint planning sessions to improve resilience.

Streamlining Cross-Border Logistics with YQN

YQN Logistics offers sea freight, air freight, cross-border e-commerce, and 3PL warehousing services to help businesses expand globally more efficiently.

Our platform offers real-time supplier monitoring, automated compliance checks, and custom clearance for redirected goods. We also assist clients in negotiating better supplier terms through data-driven insights. Clients using our services report a 25–30% improvement in operational efficiency and faster fulfillment.

If you’re an importer/exporter looking for flexible logistics or warehousing services in the U.S., YQN is here to help. Reach us at info@yqn.com or visit our website for more information.

See Also

Leveraging Bonded Warehouses to Lower US Tariffs in 2025

Comprehensive Overview of the 2025 US-Canada Tariff Schedule

Impact of US Tariff Suspension on Asian Exports and Supply Chains

Freight Trends in the Chinese Market for March 2025

Potential Impact of US Port Fees on Chinese Shipping Operations

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.