2025 US–Canada Tariff Timeline: A Full Breakdown

The escalating tariff conflict between the United States and Canada is starting to bite. A flurry of tariff announcements, retaliatory measures, and policy shifts since the start of 2025 has shaken supply chains, spooked markets, and left businesses scrambling for answers. In this article, we break down the full timeline of this rapidly unfolding trade conflict and explain what it means for industries on both sides of the border.

Timeline of the 2025 US–Canada Tariffs

January 20, 2025

President Trump signs the America First Trade Policy memorandum, instructing U.S. departments to complete trade policy reviews by April 1.

February 1, 2025

The U.S. announces a 25% tariff on most Canadian goods and a 10% tariff on Canadian energy products, set to begin February 4. Canada responds with its own 25% tariffs on selected American goods, also effective February 4.

February 3, 2025

Both governments agree to delay the implementation of tariffs by 30 days, moving the start date to March 4.

February 10, 2025

The U.S. introduces new 25% tariffs on steel and aluminum imports from all countries, including Canada, scheduled to take effect on March 12.

February 13, 2025

Trump announces a plan for “reciprocal tariffs” on countries that maintain tariffs on U.S. exports, with actions expected after April 1.

March 4, 2025

U.S. tariffs of 25% on Canadian goods and 10% on Canadian energy and potash exports take effect. Canada imposes countermeasures:

25% tariffs on $30 billion in U.S. imports.

Plans for further retaliatory tariffs pending public consultation.

Later, the U.S. narrows the scope of its tariffs to non-CUSMA compliant goods only.

March 12, 2025

The U.S. enacts 25% tariffs on Canadian steel and aluminum.

March 13, 2025

Canada responds with 25% reciprocal tariffs on:

$12.6B worth of U.S. steel products,

$3B in U.S. aluminum,

$14.2B in other U.S. goods.

Total value: $29.8 billion.

April 3, 2025

The U.S. imposes 25% tariffs on Canadian automobiles, impacting an industry that supports over 500,000 jobs in Canada.

April 9, 2025

Canada retaliates with a 25% tariff on non-CUSMA compliant U.S.-made vehicles, and also applies the tariff to the non-Canadian and non-Mexican content in CUSMA-compliant vehicles.

Vehicle imports from the U.S. totaled $35.6 billion in 2024.

April 9, 2025

Trump suspends reciprocal tariffs for 90 days on all countries except China. Tariffs on Chinese goods are raised from 104% to 125% after China imposes retaliatory duties of up to 84%.

April 16, 2025

Bank of Canada Governor Tiff Macklem calls the tariffs a “once-in-a-century” economic shock. He warns that the Canadian economy faces recession risks and long-term structural damage.

To mitigate tariff risks and learn more about transshipment trade and bonded areas, feel free to contact YQN at info@yqn.com. Our cross-border logistics experts will provide customized services and free consultations for your cross-border logistics needs.

Economic Impacts of Canada US Tariffs

Supply Chains Strained Across Key Sectors

Steel and Aluminum: U.S. manufacturers have reported delays and cost overruns as they seek alternative suppliers or absorb the price hike. Canadian producers are losing ground in their largest export market, while U.S. buyers are left juggling tighter inventories.

Energy: The 10% tariff on Canadian oil has increased input costs for U.S. refiners, pushing gasoline prices upward. With no immediate alternative to Canadian crude, the U.S. energy sector faces a short-term inflationary squeeze.

Dairy and Agriculture: American dairy exporters—already limited by Canada’s supply management system—now face retaliatory tariffs that make their products even less competitive. Economists from Cornell warn that without resolution, U.S. dairy could see hundreds of millions in annual losses.

Lumber: Higher duties have reduced cross-border lumber shipments, squeezing the U.S. construction sector. Contractors report rising costs and project delays, especially in residential housing.

Long-Term Risks

While the White House has recently paused its reciprocal tariffs on all countries except China, the damage from earlier moves is already being felt. Canada’s economy, highly reliant on U.S. demand, is under pressure. American businesses are caught in the middle—paying more, selling less, and hiring cautiously.

The macro impact is coming into focus. Canada’s central bank now warns of a possible recession, with GDP projected to contract by 2.5% by year’s end. Inflation could spike to 7.2%, hitting consumers hard. Up to 150,000 Canadian jobs—many in export-heavy sectors—could be lost.

To mitigate tariff risks and learn more about transshipment trade and bonded areas, feel free to contact YQN at info@yqn.com. Our cross-border logistics experts will provide customized services and free consultations for your cross-border logistics needs.

Future Scenarios for Canada US Tariffs

Negotiation Prospects

The possibility of resolving the tariff dispute between the US and Canada hinges on effective negotiations. Both nations have shown interest in reducing economic tensions, but achieving a consensus remains challenging. A base case scenario suggests that Canada and Mexico could secure exemptions from new tariffs through temporary agreements. This would require minor concessions, such as increased market access for US goods.

Businesses can prepare for potential outcomes by diversifying suppliers and optimizing inventory management. These strategies enhance resilience against tariff disruptions. Legal reviews and strategic contract adjustments also play a critical role in mitigating risks. Companies must remain proactive to adapt to evolving trade policies.

Risks of Prolonged Disputes

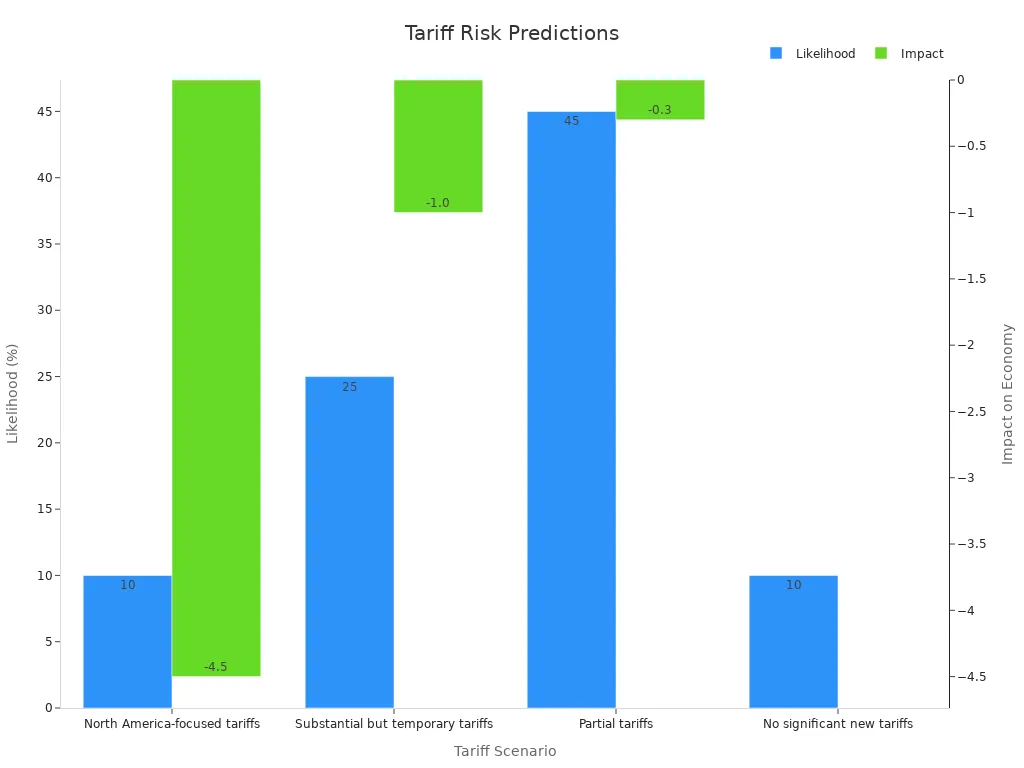

Prolonged tariff disputes pose significant risks to both economies. Historical data reveals that extended trade wars often lead to reduced GDP growth and higher inflation. For instance, a scenario involving substantial but temporary tariffs predicts a 25% likelihood of occurrence, with a 1.0% negative impact on the economy. However, a long-lasting trade war could result in a 4.5% economic decline.

Tariff Scenario | Likelihood | Impact on Economy |

|---|---|---|

North America-focused tariffs | 10% | -4.5% |

Substantial but temporary tariffs | 25% | -1.0% |

Partial tariffs | 45% | -0.3% |

No significant new tariffs | 10% | 0% |

The interconnected nature of the US and Canadian economies amplifies these risks. Retaliatory measures could escalate tensions, further disrupting trade and investment flows. Policymakers must act swiftly to prevent long-term damage.

Long-Term Trade Outlook

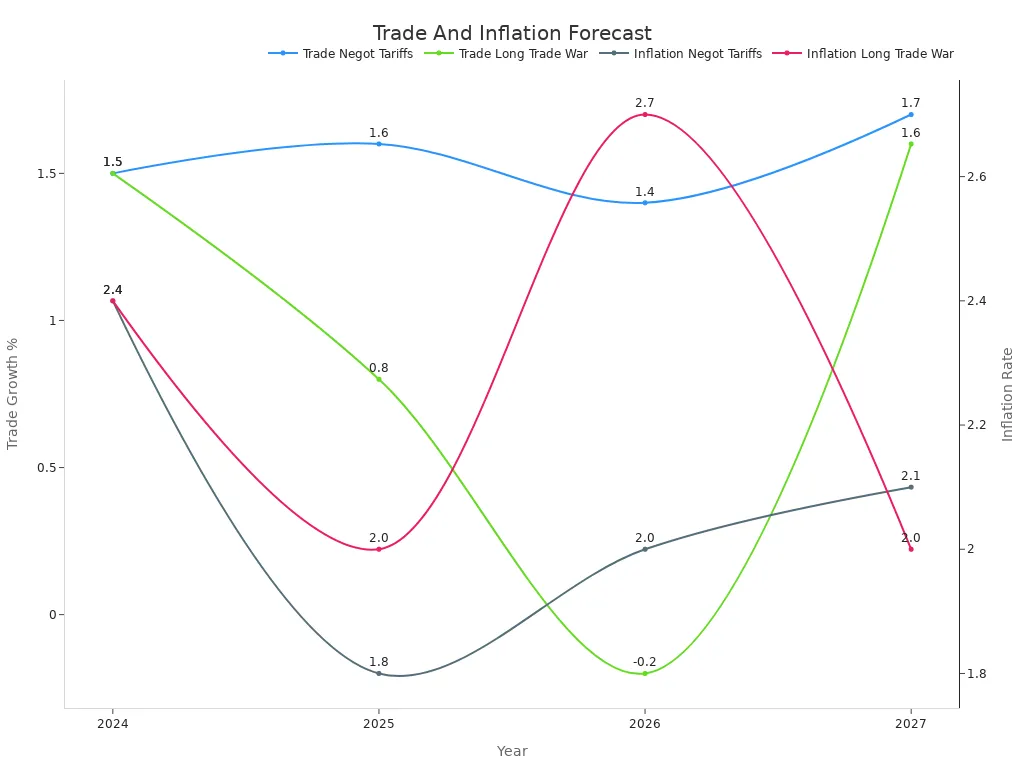

The long-term trade outlook for the US and Canada depends on how the tariff dispute evolves. Two scenarios highlight the potential outcomes. In the first scenario, negotiated tariffs lead to gradual economic recovery, with GDP growth reaching 1.7% by 2027. In contrast, a prolonged trade war could result in a GDP decline of 0.2% by 2026, followed by a slow recovery.

Year | Scenario 1 (Negotiated Tariffs) | Scenario 2 (Long-lasting Trade War) |

|---|---|---|

2024 | 1.5% | 1.5% |

2025 | 1.6% | 0.8% |

2026 | 1.4% | -0.2% |

2027 | 1.7% | 1.6% |

Inflation trends also vary under these scenarios. Negotiated tariffs could stabilize inflation at 2.1% by 2027, while a trade war might cause fluctuations, peaking at 2.7% in 2026. Businesses must adapt to these conditions by exploring alternative sourcing regions and leveraging treaty-based investment protections.

Note: The Bank of Canada emphasizes the importance of resolving tariff disputes to avoid long-term economic instability. Policymakers must prioritize collaboration to ensure sustainable growth.

To navigate the challenges of the 2025 tariffs, businesses must adopt effective strategies. YQN offers expert guidance on transshipment trade and bonded areas. Contact info@yqn.com for tailored solutions.

See Also

Utilizing Bonded Warehouses to Lower Tariffs in 2025

Impact of U.S. Tariff Suspension on Asian Exporters and Supply Chains

Shipping Containers from Singapore to the U.S. in 2025

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.