U.S. Tariff Pause: What It Means for Asian Exporters and Global Supply Chains

In April 2025, U.S. President Donald Trump implemented a sweeping new round of reciprocal tariffs. Just days later, a 90-day pause on most of the newly announced tariffs was declared—with China as the only exception—offering a critical opportunity for exporters to adapt.

This unexpected move has sent shockwaves across the global supply chain. Exporters from Vietnam and Malaysia are racing to front-load shipments, while shippers and logistics providers are recalibrating routes, costs, and capacity planning to make the most of the limited window. For many, this is a make-or-break moment that will shape operational decisions for months to come.

Overview: U.S. Tariffs Hit Major Asian Exporters

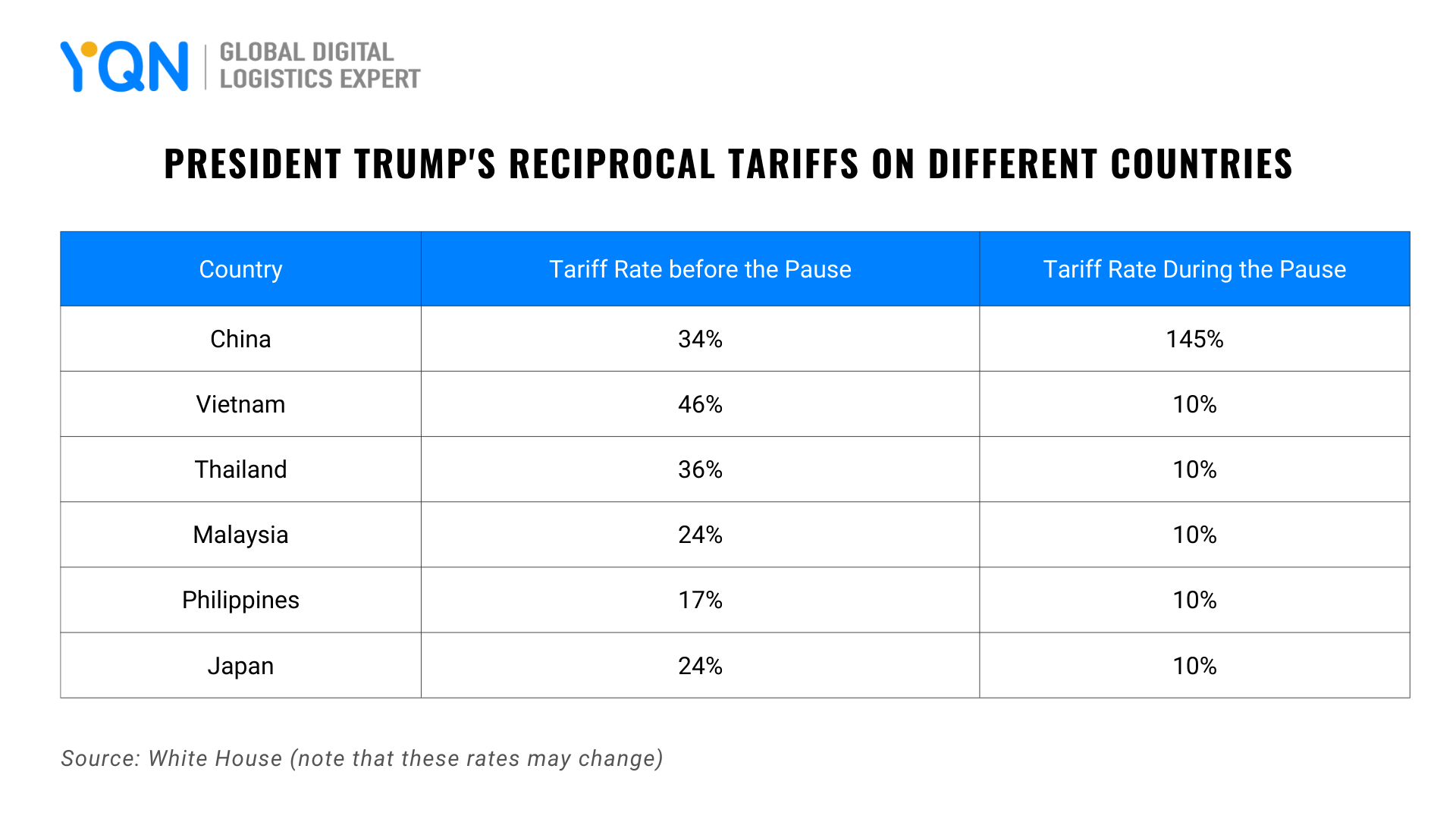

The 2025 tariff expansion is widely seen as one of the most aggressive trade policy maneuvers in recent memory. With reciprocal tariff rates ranging from 20% to over 100%, the measures target core sectors in manufacturing, electronics, automotive, textiles, and semiconductors. Here’s how the key Asian economies are impacted:

China: Facing the steepest tariffs across multiple categories, including electronics, auto parts, and consumer goods. Transshipped goods through third countries are also under scrutiny.

Vietnam: Vietnam’s large garment and electronics export sectors are under pressure. U.S. has expressed concerns about transshipment practices, making Vietnamese exporters vulnerable despite growing demand.

Thailand: A hub for electronics assembly and agricultural exports, Thailand is seeing ripple effects across its SME sector, which relies heavily on U.S. buyers.

Malaysia: Semiconductor and green energy tech exports—especially solar panels—are hit by increased tariffs, jeopardizing growth in Malaysia’s high-tech manufacturing corridors.

Philippines: Electronics and processed food exports are facing higher tariffs, causing concerns among local producers and raising logistics costs amid already tight container availability.

Japan: Tariffs on machinery and automotive parts threaten Japan’s long-established tech exports to the U.S. Market sentiment has been cautious, with trade groups warning of production slowdowns.

Economists Slam Trump’s Tariff Strategy

Multiple economists and institutions have voiced criticism regarding the long-term consequences of President Trump’s tariff policies.

A recent report by the Penn Wharton Budget Model, a research-based initiative that provides transparent economic analysis of public policy’s fiscal impact, concludes that although the tariffs might generate significant revenue—over $5.2 trillion over 10 years on a “strict conventional” basis—they would reduce GDP by approximately 8% and lower wages by 7%.

Janet Yellen, the former Federal Reserve Chair and U.S. Treasury Secretary, described President Trump’s tariffs as “legitimately damaging to the U.S. economy.” She noted that the tariffs on China alone could impose a substantial burden on U.S. households and businesses.

The Financial Times further criticizes Trump’s unpredictable behavior, describing it as an exploitation of power designed to create chaos. They argue that such actions “paralyze business, raise prices, and slow the economy.”

Exporters Scramble to Ship Goods During Tariff Pause

The 90-day tariff pause has triggered a rush among Asian exporters to maximize shipments before the potential resumption of tariffs. Exporters across Southeast Asia are scrambling to secure vessels, containers, and warehouse space to meet the heightened demand.

In Muar, a key hub for Malaysia's furniture industry, workers are putting in overtime to beat the 90-day deadline. The CFO of a furniture factory that exports 100% of its products to the U.S. reported shipping more than 30 containers in the past four days—equivalent to its usual monthly shipment volume.

Vietnam is also feeling the pressure to front-load as many shipments as possible during the 90-day window, amid fears of unpredictable tariff reimpositions. A furniture factory owner in Hanoi shared that his business, which had slowed due to earlier tariffs, is now inundated with orders from U.S. clients.

In contrast, China, now facing the highest U.S. tariffs, is focusing on redirecting exports to its domestic market. E-commerce giant JD.com has announced a 200 billion yuan initiative aimed at supporting Chinese exporters. The company plans to directly purchase high-quality goods from exporters, create a dedicated section on its platform to promote these products, and provide traffic and marketing support to help mitigate losses from reduced overseas sales.

Some Exporters Push Back on Irrational Moves

While some exporters are pushing shipments aggressively, others are reacting out of desperation. It is reported that some Chinese exporters to abandon shipments mid-voyage to avoid heavy tariff costs.

A Chinese export company revealed that their U.S.-bound container volume had dropped sharply from 40-50 containers a day to just 3-6, following the U.S. tariffs on Chinese imports. Many factories have halted shipping plans entirely, and orders already at sea are being re-costed or abandoned outright.

Industry insiders stress the importance of working with reliable logistics partners and forecasting tariff risks, rather than making reactionary decisions that can harm long-term business sustainability.

Need to Ship Before the Window Closes? We’re Here to Help.

At YQN, we specialize in time-sensitive freight solutions that help you beat tariff deadlines and optimize your shipping routes. Whether you're moving goods from China or Southeast Asia to North America or Latin America, our end-to-end logistics services ensure speed, security, and flexibility.

✅ Real-time shipment tracking

✅ Customs clearance and tariff advisory

✅ Flexible ocean and air freight solutions

Don’t wait until the 90-day pause ends—reach out now and secure your logistics advantage.

Contact us today at info@yqn.com.

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.