Shipping Industry Growth in 2024: Key Insights, 2025 Outlook, and Implications for Importers & Exporters

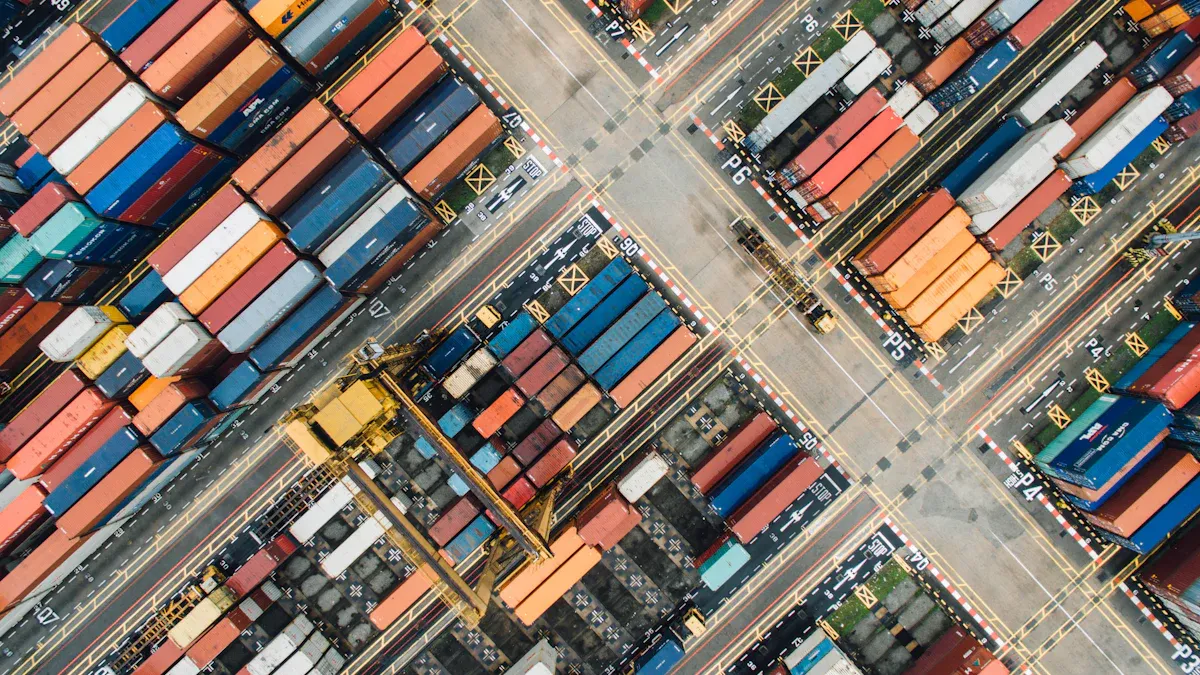

The shipping company industry has witnessed remarkable financial growth in 2024. With the shipping container market projected to grow from USD 10.41 billion in 2024 to USD 11.71 billion in 2025, trends indicate sustained expansion.

Current Financial Trends in the Shipping Industry

Revenue Growth and Market Recovery

The shipping industry has demonstrated notable financial performance in 2024, driven by increasing market demand and operational improvements. For example:

ZIM Integrated Shipping Services posted impressive financial results for 2024 earlier this week, with record-breaking results; revenues for the full year were $8.43 billion, a year-over-year increase of 63%. This was driven by upscaled capacity and optimized cost structures. The company's fleet transformation played a key role, enabling a 14% year-over-year volume increase—outpacing the market’s 6% growth. Market share gains were fueled by new capacity on the Asia-U.S. East Coast trade, successful expedited U.S. West Coast services, and an expanded presence in Latin America.

Evergreen Marine Corp., one of Taiwan’s leading shipping companies, reported a remarkable 67.53% rise in consolidated revenue to NT$463.57 billion (approximately USD 13.91 billion) in 2024. This marks the third-highest performance in the company’s history, driven by proactive fleet optimization and strategic route adjustments amid a challenging global shipping environment.

Maersk delivered robust financial results for 2024, showcasing growth across all segments and a substantial boost in profitability. EBIT surged by 65%, reaching USD 6.5 billion. These results were fueled by increased container demand and higher freight rates in the Ocean segment, strong revenue and volume growth in Terminals, and notable improvements across most Logistics & Services products.

Impact of Freight Rates and Demand Fluctuations

Freight rates have experienced volatility in 2024 due to fluctuating market demand and geopolitical uncertainties. Drewry’s World Container Index recorded a 7% decline, settling at $2,368 per 40ft container. Similarly, the Freightos Baltic Index reported an average rate of $3,051, reflecting ongoing disruptions in global trade. Despite these challenges, rates remain above pre-pandemic levels, indicating a recovering market. Analysts predict that easing geopolitical tensions could stabilize demand, offering a more predictable outlook for 2025.

Key Opportunities for Shipping Company Growth

Expansion of Global Trade and Market Recovery

The global shipping market continues to benefit from the expansion of international trade. A projected annual growth rate of 3.6% in global container trade from 2024 to 2028 underscores the sector's potential. This growth aligns with ongoing investments in fleet expansion and advancements in digital logistics.

Adoption of Green Shipping and Sustainability Initiatives

Sustainability has become a cornerstone of the global shipping market. Companies are adopting green shipping practices to meet international decarbonization goals. By 2030, the industry aims to reduce carbon intensity by at least 40% compared to 2008 levels. Medium-term goals include cutting greenhouse gas emissions by up to 70% by 2040, with a long-term target of achieving net-zero emissions by 2050.

New Ship Deliveries and Fleet Modernization

Fleet modernization represents a significant growth driver for the shipping company sector. Major players are investing heavily in infrastructure and advanced technologies. CMA CGM, for instance, has allocated $20 billion toward U.S. port infrastructure. Additionally, many companies are expanding their LNG-powered fleets to meet rising demand.

Challenges and Risks in the Shipping Industry

Geopolitical Tensions and Regulatory Changes

Geopolitical tensions and evolving regulations significantly impact shipping companies' performance. Trade policies, such as proposed U.S. tariffs on Chinese-built vessels, could double shipping costs for U.S. exports. Carriers are exploring alternative routes to mitigate these rising expenses. Additionally, the dissolution of the 2M Alliance and the formation of the Gemini Cooperation are reshaping global trade routes, creating uncertainty in market supply and demand.

Market Uncertainties and Economic Volatility

Economic volatility remains a pressing concern for the shipping industry. Tariff-related tensions disrupt trade routes, leading to contractual disputes and renegotiations.

Sentiment analysis highlights the industry's mixed outlook. In Q1 2025, positive sentiment accounted for only 20%, while negative sentiment reached 38%. Despite these challenges, revenue trends show promise, with a 68% positive revenue growth in Q1 2025, increasing to 74% in Q2.

2025 Outlook for the Shipping Industry and Importers/Exporters

The shipping industry anticipates steady growth in global trade volumes in 2025, driven by increased demand for efficient logistics solutions. The 2025 economic and geopolitical landscape presents both challenges and opportunities for importers and exporters.

The potential implementation of aggressive tariffs—such as the proposed tariff on Chinese goods and on other trading partners (Canada, Mexico) by the U.S.—could disrupt supply chains and inflate costs for importers. For exporters, retaliatory tariffs (e.g., from Europe) may reduce market access, particularly in politically sensitive sectors like automotive manufacturing. Deloitte’s baseline scenario suggests importers might frontload orders in 2025 to avoid immediate tariff impacts, but this could strain logistics and inventory management. Exporters reliant on U.S. markets, such as Canada and Mexico, face risks from potential trade restrictions, necessitating diversification strategies.

About YQN

YQN has established strong partnership with more than 300 shipping companies, including Maersk, MSC, CMA CGM and COSCO Shipping. If you have any shipping inquiries, please contact us at info@yqn.com.

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.