Key Changes to Single Administrative Document Regulations in 2025

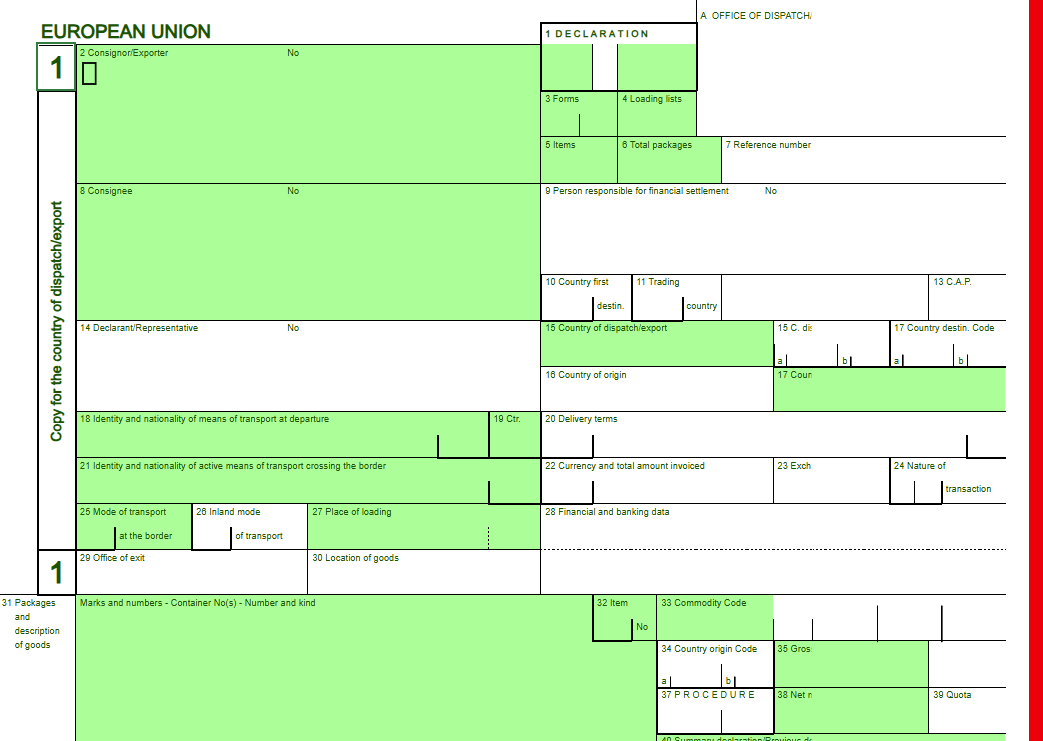

Single Administrative Document (SAD) is a form for custom declarations for trading between EU countries and non-EU countries. The 2025 updates to the SAD document introduce three transformative changes aimed at simplifying customs procedures and enhancing trade efficiency.

Overview of the 2025 Single Administrative Document Updates

Transition to Digitalization

In replacing traditional paper form, the Delta I/E system revolutionizes EU customs with full digitalization. This automated platform accelerates clearance times, improves data accuracy, and enables cross-border data sharing.

Key Changes to the SAD Framework

The updated Single Administrative Document mandates three new fields to align with EU sustainability regulations:

Carbon Emission Data

Report transport-mode-specific CO₂ emissions (air/sea/road/rail)

Policy Basis: EU Carbon Border Adjustment Mechanism (CBAM)

Supply Chain Due Diligence

Declare no conflict minerals or forced labor in production.

Policy Basis: Corporate Sustainability Due Diligence Directive (CSDDD)

Circular Economy Label

State recyclable material percentage (e.g., plastic content).

Policy Basis: European Green Deal

Timeline for Implementation

The EU has outlined a phased timeline for implementing the 2025 SAD updates. The transition to Delta I/E system will begin in January 2025, with full adoption expected by mid-year.

If you want to learn more about logistics consulting for exports from China to Europe, please contact info@yqn.

New Requirements for Customs Declarations

Mandatory Data Elements

The updated customs regulations for 2025 introduce a comprehensive list of mandatory data elements for all shipments. These elements aim to enhance the accuracy and transparency of customs declarations. Businesses must now provide detailed information for every shipment, regardless of its value. The table below outlines the required data:

Mandatory Data Elements for All Shipments | Additional Data Elements for Certain Shipments |

|---|---|

1. Clearance Tracing Identification Number | 1. Seller and purchaser names and addresses |

2. Country of shipment | 2. Advertised retail product description |

3. 10-digit Harmonized Tariff Schedule | 3. Marketplace name, website, or phone number |

4. At least one of the following: | 4. Partner Government Agency documents or data |

- Product URL | |

- Product picture | |

- Product identifier | |

- Shipment x-ray or foreign security | |

screening report number |

If you want to import to EU, YQN Logistics' professionals will offer accurate sad documents completion for you. If you want free single administrative document sample, welcome to contact info@yqn.com.

Impacts on Shipments and Businesses

Practical Steps to Meet the Updated Requirements

Adapt to Stricter Low-Value Shipment Rules

All goods require full declarations: Previously exempt shipments ≤€150 must now be fully declared via SAD.

Name e-commerce platforms: Include the platform’s name and EORI number for sales facilitated through third-party platforms.

Ensure Data Accuracy and Real-Time Updates

Validate HS codes: Use the EU’s dynamic TARIC database to avoid fines (1–5% of goods value for errors >5%).

Declare CIF value: Include Cost, Insurance, and Freight. Omitting costs risks penalties and back taxes.

Automate Compliance and Risk Controls

Prepare for real-time checks: Customs will cross-verify SAD data with logistics records (e.g., bills of lading). Discrepancies trigger inspections.

Update systems for dynamic HS codes: Outdated codes may lead to rejected declarations.

Meet Deadlines and Select Correct Copies

Timely submissions: File export declarations 24 hours before departure (ENS rules) and imports before arrival to avoid fees (~€100/day).

Pro Tip: Integrate compliance tools (e.g., TARIC validators, API-linked customs platforms) to streamline workflows and minimize errors.

FAQ

How can businesses prepare for the transition to Delta I/E?

Businesses should update their systems to align with Delta I/E's digital framework. Investing in automation tools, training staff on new requirements, and conducting internal audits will ensure a smooth transition. Early preparation minimizes disruptions and ensures compliance with the updated customs regulations.

Are there penalties for non-compliance with the new regulations?

Yes, non-compliance can result in shipment delays, financial penalties, or even the seizure of goods. Businesses must ensure accurate data submissions and adhere to the updated requirements to avoid these risks. Partnering with customs experts can help mitigate compliance challenges.

How do the updates impact low-value shipments?

The updates require additional documentation for low-value shipments, ensuring the same level of scrutiny as high-value goods. While this increases compliance responsibilities, businesses benefit from streamlined processes and improved customs clearance efficiency under the Delta I/E system.

Tip: Early compliance with the 2025 updates ensures smoother operations and minimizes disruptions. Businesses should act now to adapt their systems and processes.

If you want to learn more about logistics consulting for exports from China to Europe, please contact info@yqn. The most professional logistics experts are here to answer your questions and provide the best logistics services tailored to your shipping needs.

For more information, visit www.yqn.com or submit your shipping needs at https://www.yqn.com/custom/seaquote.

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.