Tariff Truce: China to US Container Bookings Surge Nearly 300%

A temporary truce in the US–China trade dispute has sparked a dramatic surge in China to US container bookings, as American importers race to ship goods ahead of potential tariff renegotiations.

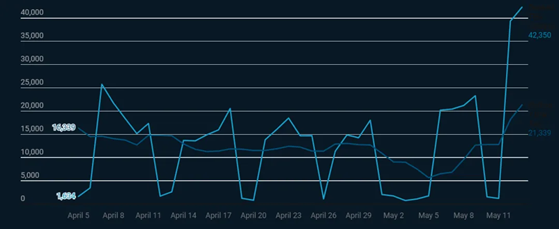

According to supply chain data from Vizion, container bookings from China to the United States have jumped nearly 300% following the mutual easing of tariffs by both nations. This spike highlights renewed urgency among importers to capitalize on the reduced duties before the window of opportunity closes.

Source: VIZION

German shipping giant Hapag-Lloyd confirmed the surge, reporting a 50% increase in bookings on its US–China routes during the first three days of the week. CEO Rolf Habben Jansen commented: “I expect volumes between China and the US to rise sharply—we're already seeing it unfold.”

Inventory Race: 90 Days to Ship Fast

Analysts anticipate a major upswing in US–China trade over the next 90 days, as businesses rush to stockpile goods ahead of any future tariff revisions. Multiple sources confirmed that thousands of containers have already been preloaded in China, ready to sail to American ports.

Companies like Amazon, Skechers, Fastenal, and Big 5 Sporting Goods are said to be ramping up inventory, ordering earlier to cushion against tariff fluctuations. Amazon executives noted that early purchasing helped avoid widespread price hikes, while Fastenal management expects elevated inventory levels to continue through the year.

Analysts: "Frontrunning" Will Define the Next Three Months

Goldman Sachs analyst Philip Sun noted: “The next 90 days will see Chinese exports explode. 'Frontrunning'—moving fast before new tariffs hit—will be the key theme.”

“Think about it,” he said. “In an uncertain world, who knows what happens next? Retail giants like Walmart might even stock up not just for 2025—but for 2026 too.”

Lu Ting, chief China economist at Nomura, echoed the sentiment, stating that April’s lull in exports could now give way to a release of pent-up shipments.

Scott Kennedy, senior advisor at the Center for Strategic and International Studies (CSIS), said companies are racing to move goods across the Pacific while tariffs remain low: “We’re likely to see a sharp rise in trade volumes. This may be the only window to ship affordably for some time.”

Rates Climb Amid Space Crunch

The container rush is already pushing up shipping rates. Analysts at Jefferies said the market is seeing “material improvement” in spot rates, driven by recovering demand and the onset of peak season.

With carriers having previously reduced capacity by over 30% on transpacific routes, a supply-demand mismatch is now inflating prices, according to YQN Logistics.

Still, YQN’s logistics experts believe the China to US container bookings pressure may ease as shipping lines redeploy vessels and restore capacity in the coming weeks.

For more updates on global trade and logistics trends, please visit www.yqn.com.

Looking to connect with reliable freight partners? Contact us by info@yqn.com and claim exclusive booking offers.

Shipping with YQN - Global Logistics at Your Fingertips

YQN has established subsidiaries worldwide, covering North America, Latin America, Southeast Asia, and the Middle East. We have partnered with 300+ top shipping and airline companies and have access to 3500+ high-quality supplier resources. YQN also has a professional customer service and fulfillment team of over 500 people to provide more worry-free and efficient international logistics services.

Contact Us

You can also email us at info@yqn.com.